The Evolution of Digital Payments and Wallets

Aiden Foster August 20, 2025

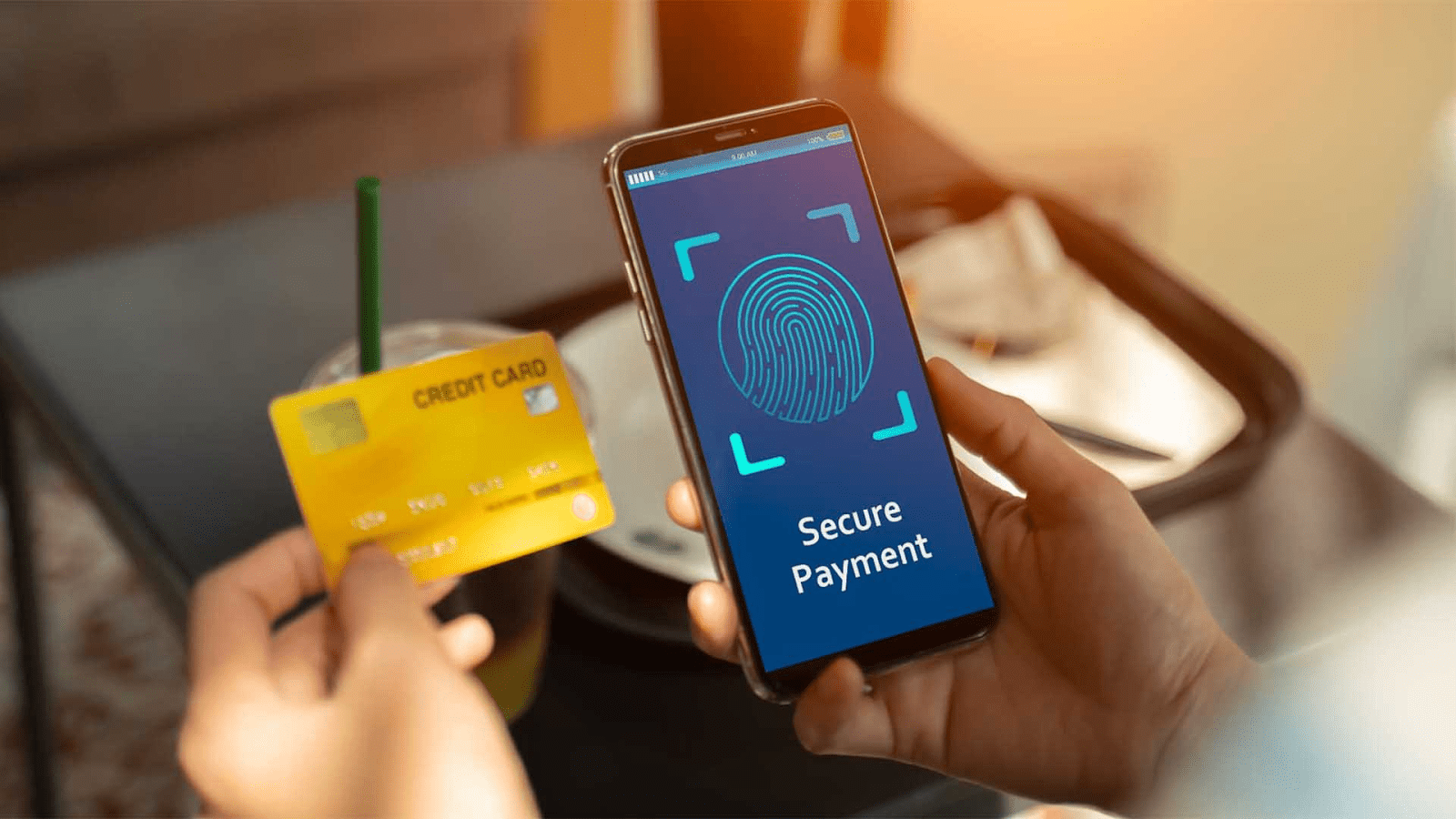

Digital wallets have rapidly transformed from convenient tools for online transactions into powerful ecosystems reshaping global commerce. In 2025, the spotlight is on one major development: digital wallet interoperability. No longer limited by borders or platforms, digital wallets are now converging into interconnected systems that allow seamless payments between regions, providers, and even currencies.

This shift is happening alongside another groundbreaking trend: the integration of stablecoins into traditional financial systems. Payment giants like PayPal, Mastercard, and JPMorgan are building frameworks that merge the security of fiat systems with the efficiency of blockchain-based assets.

Together, digital wallet interoperability and stablecoin adoption are reshaping how money moves around the world. Let’s explore how these innovations are unfolding, why they matter, and what comes next.

What Is Digital Wallet Interoperability?

At its core, digital wallet interoperability refers to the ability for different wallets, apps, and payment networks to communicate and process transactions seamlessly. Traditionally, wallets like PayPal, Venmo, Alipay, or Google Pay have operated as closed ecosystems. Interoperability aims to change that by allowing one wallet to interact with others, even across countries and payment systems.

The concept addresses major pain points:

- Cross-border commerce barriers: A user in India might prefer UPI payments, while a U.S. merchant accepts PayPal. Interoperability removes the need for multiple accounts.

- Consumer convenience: Instead of juggling five or more wallets, one can make global transactions through a single preferred platform.

- Financial inclusion: People in regions with limited access to banking gain smoother pathways into global digital commerce.

This evolution mirrors the way mobile phones went from carrier-specific services to global networks—creating a truly connected environment for payments.

PayPal World: A Leap Toward Global Wallet Integration

One of the most talked-about developments in 2025 is PayPal’s PayPal World, a cross-border payments platform designed to unify local wallets on a global scale.

PayPal World enables users of popular regional payment systems like India’s UPI, Mexico’s Mercado Pago, China’s Tenpay Global, and Venmo in the U.S. to transact seamlessly across borders. This means a tourist from Mexico can use Mercado Pago in the United States through PayPal’s system, while an Indian shopper can purchase goods from American e-commerce sites using UPI.

The platform is built with open APIs, allowing additional wallets to join over time. This openness is critical to ensuring that interoperability grows beyond a small set of dominant players.

For businesses, PayPal World simplifies cross-border transactions by reducing integration complexity and expanding access to millions of customers worldwide. For consumers, it creates a frictionless global payment experience.

Stablecoins Enter the Mainstream: Mastercard, JPMorgan, and Beyond

While interoperability makes wallets more connected, stablecoins are making them more versatile. Stablecoins are cryptocurrencies pegged to fiat currencies like the U.S. dollar or euro, designed to minimize volatility while leveraging blockchain’s speed and efficiency.

In 2025, they are no longer niche. Major financial institutions are weaving them into everyday payments.

Mastercard’s Stablecoin Initiative

Mastercard has partnered with stablecoin issuers to integrate fiat-backed tokens such as FIUSD into its global payments network. This means consumers can spend stablecoins at millions of merchants worldwide using Mastercard-linked cards. Stablecoins are effectively becoming another currency option at checkout, alongside dollars, euros, and yen.

This move positions Mastercard as a bridge between traditional finance and decentralized assets, ensuring that blockchain-based currencies can be used in real-world commerce.

JPMorgan and Coinbase Partnership

JPMorgan has taken another significant step by allowing Chase cardholders to purchase cryptocurrencies, including stablecoins like USDC, through Coinbase. This initiative also allows card rewards to be redeemed directly in stablecoins.

By enabling everyday consumers to interact with stablecoins through mainstream banking services, JPMorgan is signaling that stablecoins are no longer experimental—they are becoming part of the financial fabric.

The Broader Stablecoin Market

Across Europe, the launch of EURAU, a regulated euro-backed stablecoin, marks another milestone. With support from major asset managers, this token is positioned to become a standard for cross-border settlements in the Eurozone.

The trend is unmistakable: stablecoins are no longer confined to trading platforms. They are being integrated into payment systems that millions of consumers use daily.

Regional Interoperability Initiatives: Wero, ASEAN QR, and More

Interoperability isn’t only about global giants. Regional efforts are also shaping the future of digital payments.

Wero: Europe’s Unified Wallet

In Europe, the launch of Wero represents a significant attempt to unify fragmented payment systems across the continent. Wero allows for peer-to-peer, e-commerce, and point-of-sale transactions while integrating features like digital identity verification and loyalty programs.

As more banks and fintechs join the network, Wero is becoming a standard payment option across multiple European countries, streamlining cross-border commerce within the EU.

ASEAN Cross-Border QR Systems

In Southeast Asia, interoperability is being achieved through cross-border QR payment systems. Countries like Thailand, Malaysia, Singapore, and Indonesia are aligning their national QR standards so consumers can use their local mobile banking apps when traveling regionally.

This initiative makes it possible for a shopper in Singapore to scan a merchant’s QR code in Bangkok and pay directly through their local wallet—without worrying about currency exchange or complex fees.

Other Notable Developments

- Sri Lanka has launched GovPay, a unified platform for digital public service payments.

- Myanmar has introduced MyanmarPay, a national QR-based system designed to standardize wallet payments across the country.

These efforts highlight a growing global trend: regional collaboration as a stepping stone to full global interoperability.

Implications for Consumers, Merchants, and Regulators

The convergence of digital wallet interoperability and stablecoin adoption carries significant implications across the financial ecosystem.

Consumers

- Global convenience: The ability to use one wallet across borders makes travel and e-commerce more seamless.

- Access to financial tools: Interoperability expands financial inclusion by giving unbanked populations access to digital payment systems.

- Security considerations: While convenient, interconnected systems may become targets for fraud, requiring advanced protections.

Merchants

- Broader customer reach: Accepting a wider range of payment methods expands market opportunities.

- Reduced complexity: Unified systems cut down on the need for multiple integrations.

- Competitive advantage: Merchants that adopt interoperable and stablecoin-friendly systems may attract more customers, especially in cross-border markets.

Regulators and Financial Institutions

- Policy alignment: Ensuring compliance across multiple jurisdictions is a complex but necessary challenge.

- Stablecoin oversight: As more stablecoins enter mainstream payments, clear regulatory frameworks are essential to protect consumers and preserve financial stability.

- Identity and privacy: Systems like Wero highlight how digital identity will become a cornerstone of secure interoperability.

What’s Next in the Interoperability Landscape

Several trends point to where digital payments are heading:

- Expansion of cross-border wallet platforms: Following PayPal’s lead, more companies will likely launch global interoperability solutions.

- Integration of central bank digital currencies (CBDCs): CBDCs may eventually connect with private wallets, creating a hybrid payment ecosystem.

- AI-driven fraud prevention: Machine learning tools will become critical in identifying suspicious activity across interoperable networks.

- Privacy-preserving technology: Research is underway into wallets that balance compliance with enhanced privacy protections.

- Deeper merchant integration: As adoption grows, merchants will push for more straightforward tools to handle interoperable payments and stablecoins.

Final Thoughts

The year 2025 marks a pivotal moment for global payments. With digital wallet interoperability expanding across borders and stablecoins being absorbed into mainstream financial systems, the future of money looks increasingly seamless and borderless.

Consumers can look forward to a world where carrying multiple wallets is unnecessary, merchants can serve international customers more easily, and regulators are tasked with balancing innovation against security.

The momentum is clear: interoperability and stablecoins are not passing trends. They are foundational to the next generation of payments.

References

- Spadafora, A. (2025, July 31). PayPal’s new cross-border payments platform looks to make sending money easier for 2 billion users. Available at: https://www.techradar.com (Accessed: 20 August 2025).

- Hanley, S. (2025, August 1). Mastercard makes a move toward stablecoins, in an effort to boost mainstream use. Available at: https://www.marketwatch.com (Accessed: 20 August 2025).

- Reuters. (2025, July 30). JPMorgan to enable crypto purchases via credit cards in Coinbase tie-up. Available at: https://www.reuters.com (Accessed: 20 August 2025).